You can make a difference in the lives of Arizona seniors

Only 2% of American philanthropic dollars are directed to senior care.

We couldn’t do this without your help.

Thank you for joining us in our mission to provide extraordinary care and make a difference in the lives of seniors in need. As a nonprofit, we rely on the generous support of our community in order to provide care and hope to our members and their families.

Over 5 Million Americans are living with Alzheimer’s, and a new diagnosis occurs every 67 seconds. Often, families are encouraged to place their loved one in a facility with minimal support, information, training, or hope. Oakwood’s Clubs allow individuals to remain at home for as long as possible, by providing a safe place for caregivers to entrust their loved one during the day. Our clubs offer enriching classes in art, movement, music, gardening, poetry, history, spirituality, wellness, nutrition, medication management, nursing care, training, and support groups.

Double the Donation

Thousands of companies match the donations made by their employees. Click here to see if your employer participates in the “Double Your Donation” employee gift matching program!

More Ways To Make a Difference

Arizona Tax Credit

How Tax Credits Work

Arizona offers a dollar-for-dollar tax credit when you donate to a Qualifying Charitable Organization (QCO).* All qualifying donations come right back to you at tax time!

What You Need to Know

- You don’t need to itemize your taxes.

- You can still claim the Education Tax Credit along with the QCO credit.

- You have until April 15 to make a qualifying donation for the previous year.

*Singles can give Oakwood Creative Care up to $421. Married couples can give up to $841. QCO Tax CODE: 20560 Please consult your tax advisor for specific questions related to your tax situation.

Memorials & Planned Giving

Memorial gifts are common upon a loved one’s death, and are a wonderful way to honor a loved one.

The imprint left on Oakwood Creative Care by members lives on long after they are no longer with us. We’re forever thankful for the joy we found together, and continue to share that joy with others that come after.

- Bequests

- Charitable gift annuities

- Gifts of appreciated assets such as securities or real estate

- Retirement plans or insurance beneficiary designations

- Charitable trusts

- Other types of deferred giving

Attend Or Sponsor An Event:

Donate Items From Our Amazon Wish Lists:

![]()

Fry’s Community Rewards Program

Simply choose Oakwood Creative Care as your preferred charity, and Fry’s will donate a portion of your purchases each month.

Anytime Auto Glass

Do you have windshield damage? Anytime Auto Glass will donate $100 to Oakwood Creative Care for your windshield insurance claim, when you text “Oakwood Care” to 480-430-4597

FUNdraising Events

When you attend an Oakwood event, you’re not just having a great night with your family & friends.

You’re supporting a nonprofit for older adults – and making a difference in the lives of Arizona seniors with Alzheimer’s and other dementias, Parkinson’s, effects of stroke, or physical and/or cognitive limitations due to aging. Every penny raised goes directly to providing care and support to Oakwood’s members, as well as their caregivers and families.

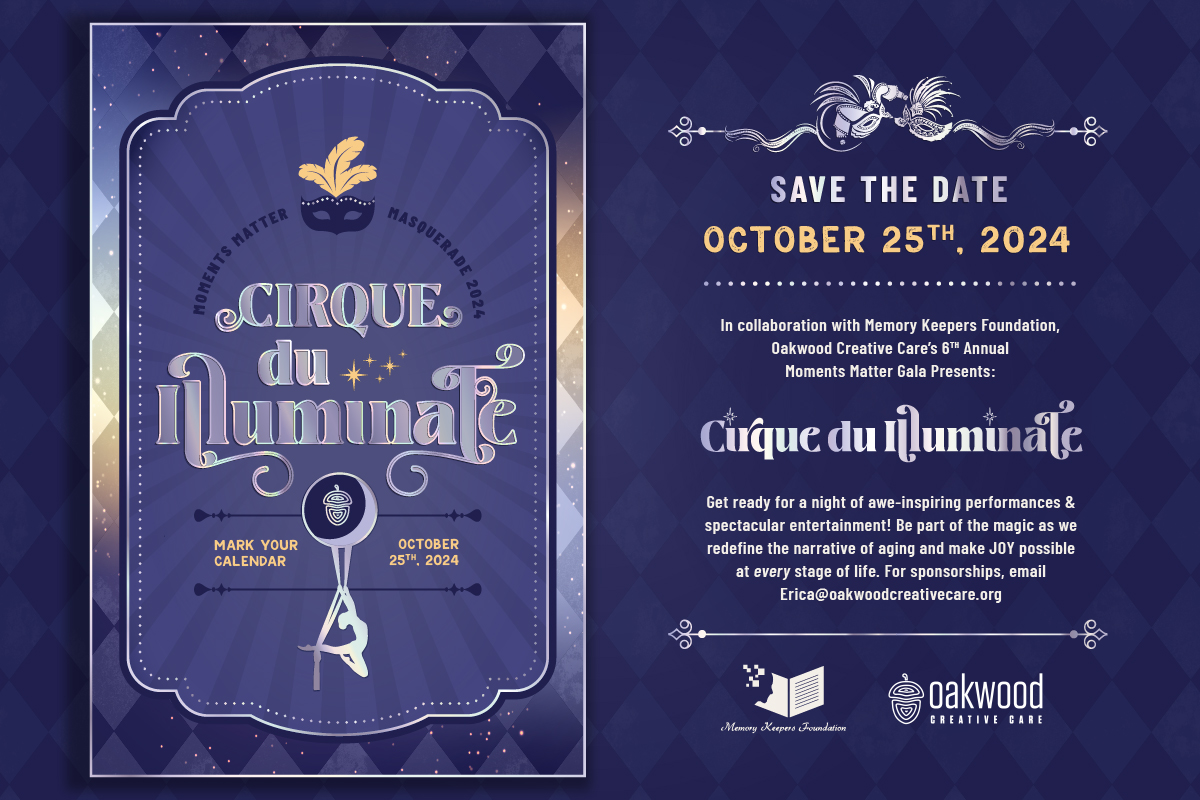

Cirque du Illuminate: Moments Matter 2024 Masquerade

Events at FABRIC 132 E 6th St, Tempe, AZ, United StatesIn collaboration with Memory Keepers Foundation, Oakwood Creative Care presents the 6th Annual Moments Matter Gala: Cirque Du Illuminate! Get ready for a night of awe-inspiring performances & spectacular entertainment. […]

Contact

Sherri Friend, CEO

sherri@oakwoodcreativecare.org